With its recent acquisition of three promising precious metals mining projects in Mexico, Bird River Resources (BDR) has committed to a new direction. "The case for gold is a compelling one and we are fully committed to transitioning BDR into a hybrid mining company" said Jon Bridgman, President "We have been studying the trends and are persuaded that we have entered a long-term bull market for gold. We further believe the hybrid mining model is the best fit for our strategy because it generates the capital needed for continuing growth from operations rather than from dilutive serial equity raises."

Positioned for Growth in a High Demand Market

- Strategic focus on high-potential gold and silver projects in a prolific mining region.

- Near-term cash flow potential through the Tadeo Mill and tolling agreements.

- Significant asset base: promising properties (San Fernando, San Ramon) and astrategic mill.

- Experienced management team with a track record of success in mining andoperations.

- Attractive entry point for investors seeking exposure to a growing gold company.

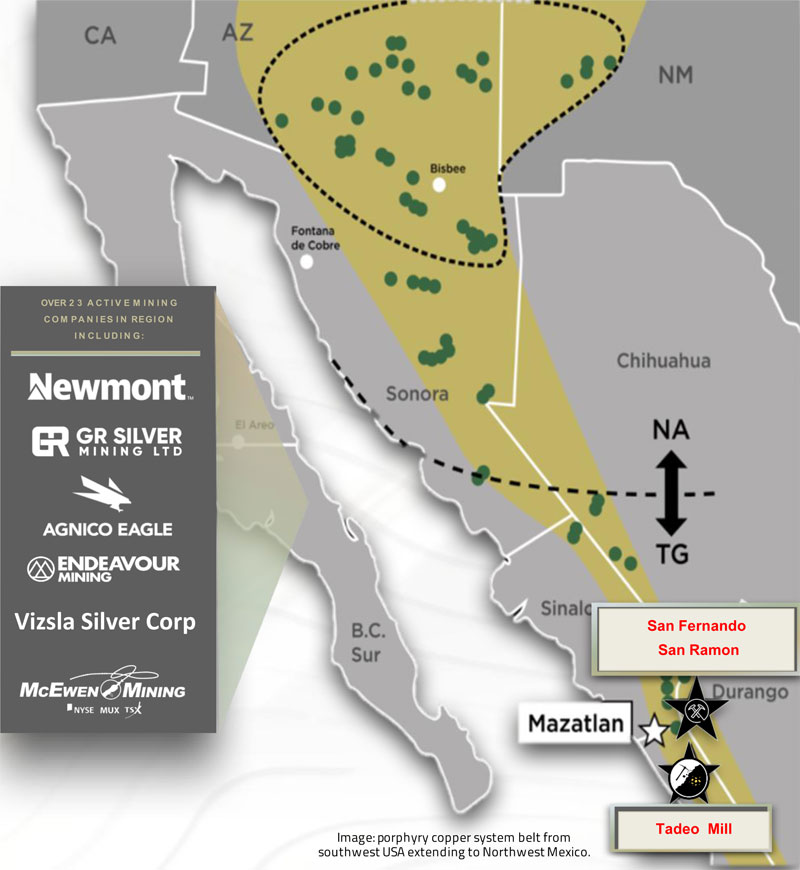

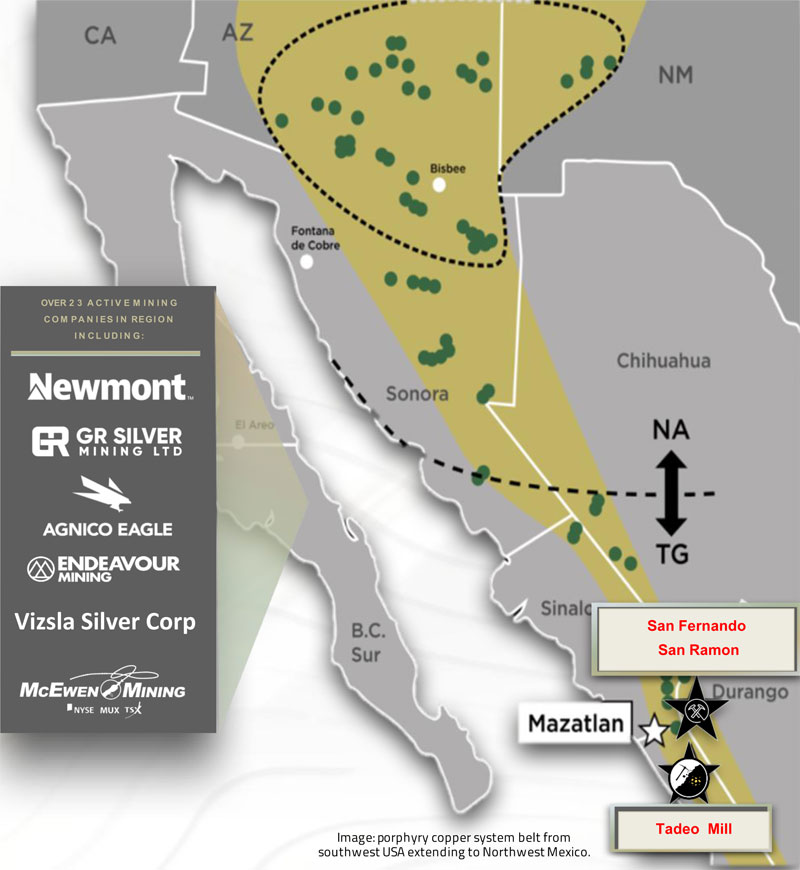

Bird River : In Highly Prospective Gold Region

- Bird River's gold properties San Fernando, andSan Miguel are positioned in one of the mostsuccessful and prospective gold miningdistricts in the Americas.

- 1,200-kilometre-long epithermal belt thatruns from Jalisco, Mexico to Arizona, USA.- The region contains a series of CopperPorphyry Systems (CPS); an occurrence thatindicates a larger amount of gold, silver andlead resource.

- Significant Mining activity in the area,several majors currently producing and/orexploring in the region, along with severalsmall companies.

Bird River: Acquired Strategic Assets & Options

Acquired 2 highly prospective and strategically located mineral properties in Q1 2025:

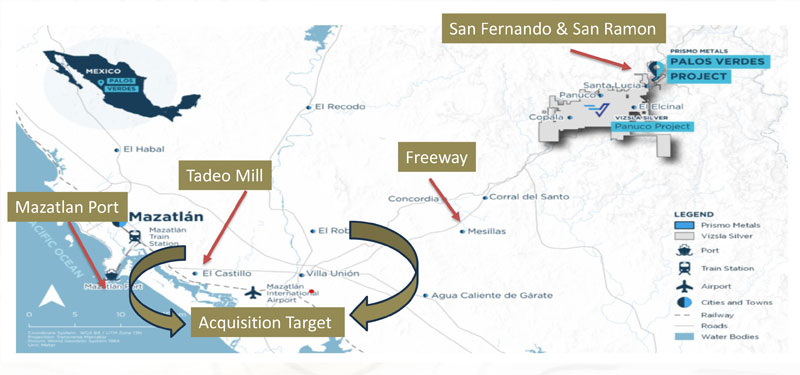

- San Fernando- San Ramon

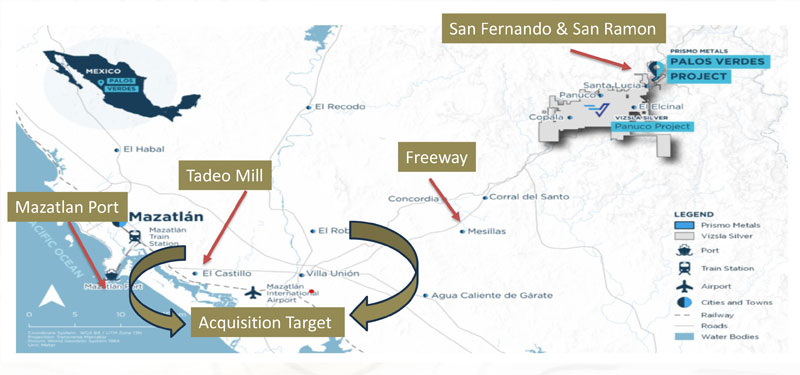

Tadeo Mill: Option to lease and acquire a 600 tons per day ore processing mill and focus on mill restart

- Mill Refurbishment plan in place- Ore sources being tied up for near term production and accelerate cash flow

Highly Prospective Region with Excellent Infrastructure

San Fernando is adjacent to the Panuco Project of VizslaVizsla: > C$ 900 million market Cap., over 2.7 million oz gold equivalent measured and indicated resource

Bird River's Six - Month Objectives

- Expand SAN FERNANDO drilling program to define resource

- Refurbish TADEO MILL to make it production ready

- Acquire additional high grade mineral properties in the region

- Develop partnerships for tolling operations for early cash flow

- Achieve net positive cash flow within 6 months of start up

Bird River's Mexican subsidiary Cotton owns three gold properties are positioned in one of the most successful and prospective gold mining districts in the Americas, along a 1,200-kilometre-long epithermal belt that runs from Jalisco, Mexico to Arizona, USA. The region contains a series of Copper Porphyry Systems (CPS); an occurrence that indicates a larger amount of gold, silver and lead resource.

Mining activity in the area has grown rapidly in the last 5 years with 6 major precious metals mining companies currently producing and/or exploring in the region, along with several small companies.

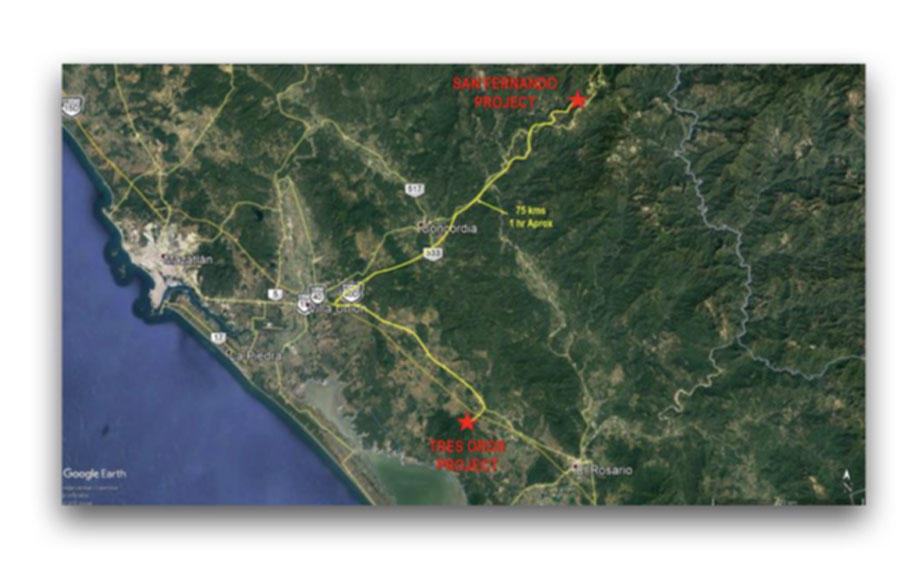

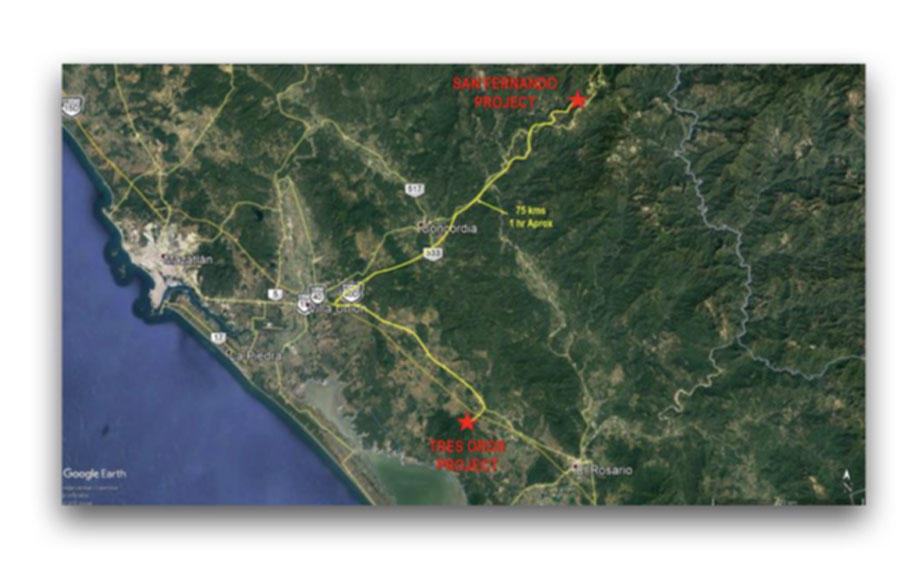

Cotton is the sole owner of three gold projects located about 65 kilometers east from the city of Mazatlan, Mexico. The three mineral property interests span over 188 hectares. ("Mineral Property Interests").

Cotton also holds an exclusive option for a right of use of an ore processing mill. The facility is located 75 kilometers southwest of the Cotton's Mineral Property Interests. The Option can be exercised until June 30, 2025

Ongoing Exploration

Bird River continues its exploration efforts;

(1) aiming to expand the inferred resource at Tres Oros

(2) a diamond drill program launched in 2024 to establish preliminary resource at San Fernando

(3) conduct preliminary exploration work at both El Tablon and Marte properties